End-user protection

Fraud prevention

As the digitalisation process has increased and the world around us has changed, the financial sector has also been transformed.

With the dynamic spread of smart devices, we are also using them to manage our finances. Social media has opened up the possibility to reach users easily and online. This also creates new opportunities for fraud.

Criminals in the digital space are turning their focus towards online payments. The dynamics of these frauds are a cause for concern.

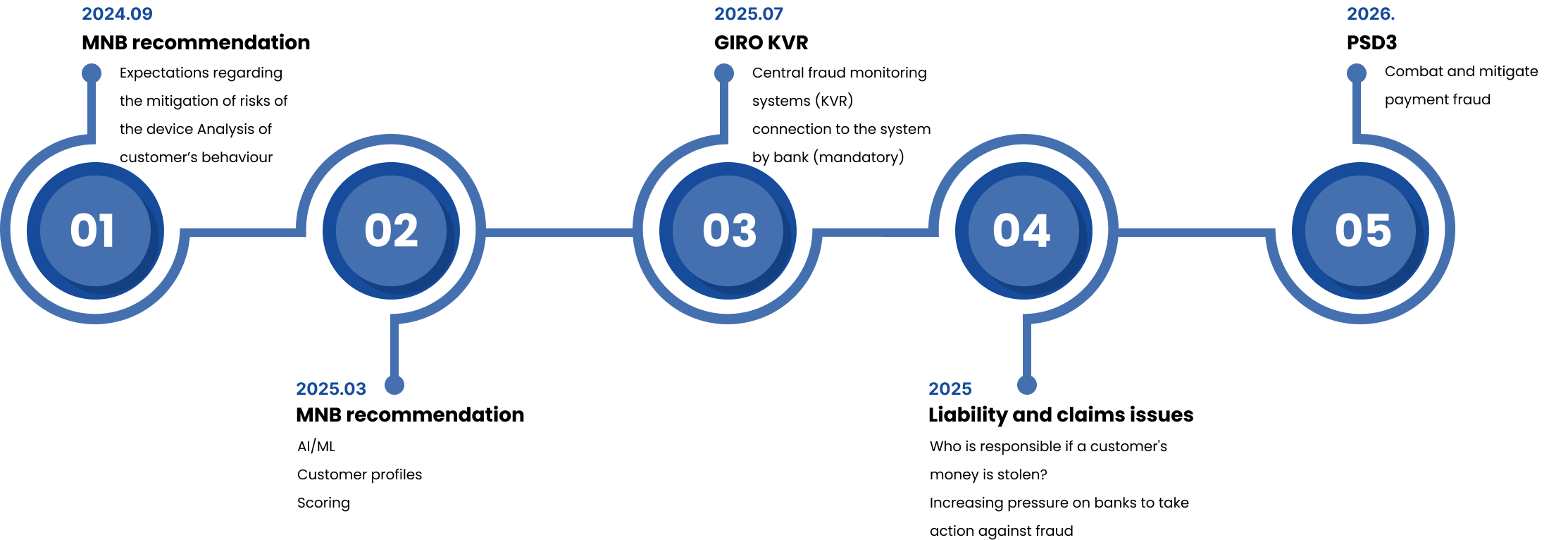

Accordingly, supervisory authorities seek to improve the systemic protection of the financial sector by setting requirements for the banking sector through regulation. The following are the laws and recommendations that we believe are relevant.

On 23 June 2023, the Hungarian National Bank issued Recommendation 5/2023 on payment services fraud. In this recommendation, the Supervisory Authority sets out the expectations it expects the Bank to have for effective fraud prevention, including prevention, detection, deterrence and treatment.

On 28th June 2023, the European Commission introduced a draft proposal encompassing a comprehensive Payment Services package. This package includes the third Payment Services Directive(PSD3) and a fresh Payment Services Regulation (PSR), intended to replace the current PSD2 and Electronic Money Directive.

PSD3, the upcoming legislation, is designed to regulate electronic payments and the banking ecosystem in the European Union's single market. PSD3 introducesrevised rules to enhance consumer protection and foster competition in electronic payments.

Copyright IT Natives Zrt.

2025.